Annuities are generally more stable than other investments, but that stability varies between different types of annuities. An annuity floor on a fixed index annuity limits potential loss from this type of investment.

Keep reading to learn how!

The Relationship Between Investment Risk and Reward

Financial products for investors come with varying degrees of risk, from extremely safe instruments such as certificates of deposit (CDs) and savings bonds to extremely risky instruments such as contracts for difference (CFDs).

The general risk-reward tradeoff is that riskier investments that carry a big chance of losing big are also potentially the most rewarding. Younger investors are more likely to recover from losses over time, so they should generally concentrate on risky, rewarding investments.

Index-Based Financial Products and Investing for Retirement

However, if you’re investigating fixed index annuities, you’re probably interested in using them to prepare for retirement. In this case, you want a lower-risk financial instrument. You’ll get lower returns, but if anything goes wrong, you won’t lose too much at a time in life when you have fewer working years to recover.

Low-risk financial products have various means of limiting how much you can lose (and how much you stand to gain). A return cap limits your capital growth to a specific value; a participation rate limits how much of your capital can earn market returns; and a spread or margin fee allows the fund to claim a share of your return.

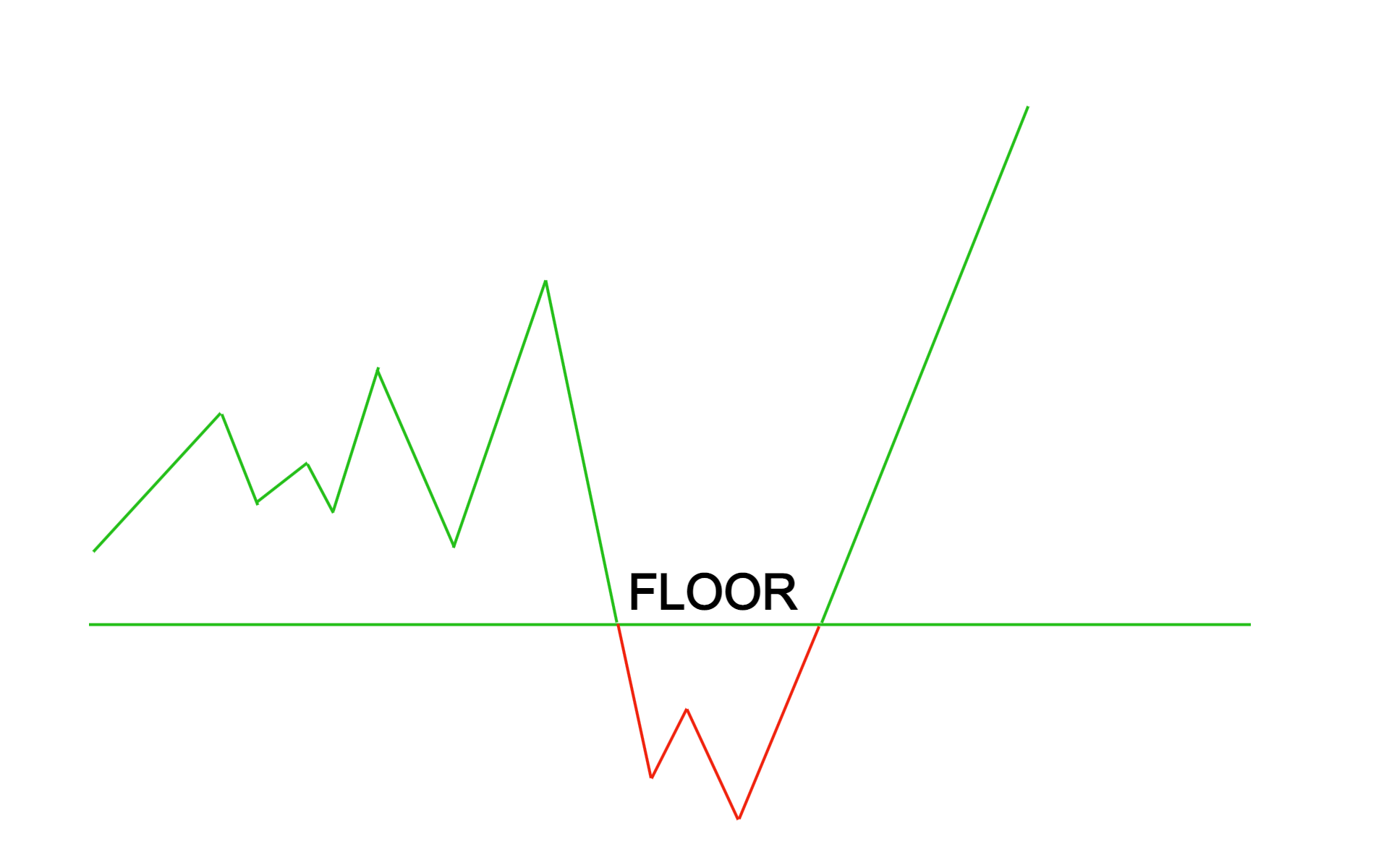

However, fixed index annuities commonly employ an adjusted value procedure to lock in gains made. They might have a guaranteed minimum return – so you always earn something – or an annuity floor, which limits your losses regardless of what’s happening in the market.

In an index annuity, the floor is stated as a guaranteed minimum interest rate, usually 0%. This means that your interest won’t be credited as negative even if an index loses value. In other words, you won’t lose any money.

In years such as 2008, when some investors lost shocking amounts of retirement savings due to stock market volatility, investors holding index annuities were completely protected – thanks to the annuity floor.

Your fixed index annuity may have rider fees or an early withdrawal penalty that could result in a small loss.

The Basics of the Different Types of Annuities

Like all annuities, an index annuity or fixed index annuity earns tax-deferred interest. You only pay the IRS when you withdraw from the annuity. It can provide you with steady, guaranteed income throughout your golden years.

But what exactly is a fixed index annuity, and how does it compare with a fixed-rate annuity or a variable annuity?

When you invest in a fixed-rate annuity, you pay an initial lump sum deposit and earn a guaranteed (fixed) interest rate. The advantage is that your capital will always earn that interest rate, even if the market crashes. The downside is that your capital will earn that interest rate even in a highly bullish market.

An index fund, on the other hand, gives you the ability to invest in a particular market index, such as the Nasdaq Composite, S&P 500, or Dow Jones Industrial Average. It provides opportunities to earn far more in bull markets, but you risk losing your principal.

Variable annuities also do not limit gains at the cost of not affording protection against loss.

The Particulars of a Fixed Index Annuity

A fixed index annuity gives you far more protection from market volatility than if you owned the stocks directly, but you receive lower returns as payment for this security. However, you still have the potential for higher rewards than you would with a fixed-rate annuity.

An interest rate floor, or annuity floor, is one of the features that insurance companies use to protect annuity owners against downturns in the interest rate.

A loss floor is a guaranteed, predetermined minimum interest rate that the insurance company will credit to the underlying investment fund of a fixed index annuity.

The amount of such a minimum guaranteed floor varies. Fixed-rated and multi-year guaranteed annuities offer at least 1%, whereas an index annuity will be lower but never less than 0.00%.

Floors on Fixed Index Annuities: The Bottom Line

A floor is a loss-protection device associated with certain types of annuities, including fixed index annuities. It limits how much you lose if there is a downturn in the market.