Retirement can seem like a distant dream, but understanding the financial landscape and making plans in advance are crucial steps if you want to get the most out of your golden years.

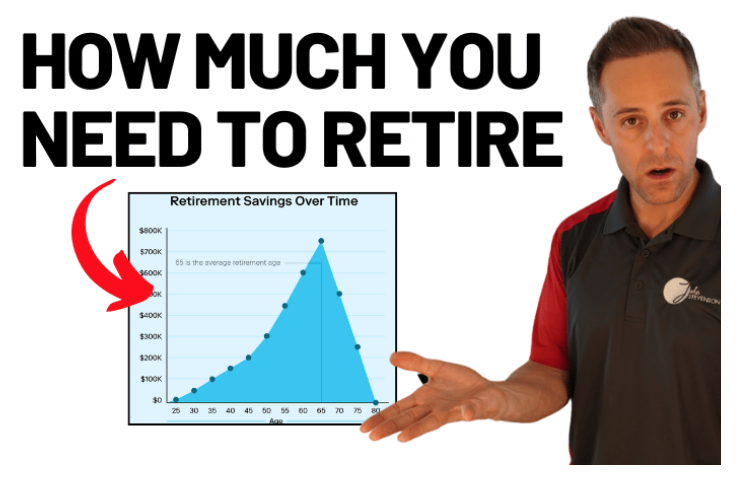

Have you ever wondered if your savings will be enough? In 2024, most financial experts say that retirees will need between $1.2 million and $1.5 million to maintain a comfortable lifestyle.

Let’s explore five important components of retirement planning and make the first step towards achieving a secure future for yourself and your loved ones.

1. Understand Your Retirement Goals

Before diving into numbers, consider your vision for post-work years.

Do you plan to travel extensively or stay close to home? Your goals will shape your financial needs. Reflect on the lifestyle you desire, including hobbies, travel, and daily living.

This will help you set a realistic savings target and ensure your golden years are truly golden.

2. Evaluate Your Current Financial Situation

After you’ve painted a clear picture of your goals, start by assessing your current financial landscape.

Take stock of your savings, investments, and any outstanding debts. Review your assets, including retirement accounts and real estate, to gauge your net worth.

Understanding your financial standing helps identify gaps and opportunities in your retirement plan. This clear picture is essential for setting realistic savings goals and ensuring a comfortable retirement.

3. Estimating Retirement Expenses

Accurately estimating retirement expenses is key to financial security.

Start by considering your current living costs, then adjust for inflation and anticipated lifestyle changes. Include essential expenses like housing, healthcare, and daily needs.

Don’t forget to account for discretionary spending such as travel and hobbies.

A thorough estimation helps you understand how much you’ll need to save to sustain your desired post-working lifestyle.

4. Income Sources During Retirement

A stable retirement relies on diversified income sources.

Social Security provides a foundation, but it’s often not enough alone.

Pensions, if available, can supplement your income. Consider employer-sponsored plans like 401(k)s and personal investments in IRAs. Annuity Associates can provide you with annuities that offer a reliable stream of income, ensuring financial stability.

By combining these sources, you can build a robust financial plan to support your retirement lifestyle and potentially sow the seeds of hereditary wealth for future generations.

5. Importance of Professional Guidance

Navigating retirement planning can be complex.

This is why professional financial advisors who can offer personalized advice are important, as they help you understand your options and make informed decisions.

They can assist in optimizing your savings strategy, managing investments, and ensuring you meet your retirement goals. Their expertise is invaluable in creating a comprehensive plan that adapts to your changing needs, providing peace of mind as you approach your golden years.

Final Thoughts

Retirement planning requires careful consideration and proactive steps.

By understanding your goals, evaluating your financial situation, and estimating expenses, you can create a secure plan; diverse income sources and professional guidance only help to strengthen your strategy.

Are you prepared for the future? Follow the Annuity Associates blog to start planning today to ensure your retirement years are as fulfilling and comfortable as you envision.